sales tax calculator reno nv

For more accurate rates use the sales tax calculator. Nevada State Tax Quick Facts.

Sales Taxes In The United States Wikiwand

The Nevada sales tax rate is currently.

. The base state sales tax rate in Nevada is 46. The Nevada NV state sales tax rate is currently 46. Exact tax amount may vary for different items.

See pricing and listing details of Reno real estate for sale. Nevada first adopted a general state sales tax in 1955 and since. 2022 Nevada state sales tax.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Reno NV. Paradise NV Sales Tax Rate. There is no applicable city tax or special tax.

2022 Cost of Living Calculator for TaxesReno Nevada and Las Vegas Nevada. For State Use and Local Taxes use State and Local Sales Tax Calculator. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794.

View 1547 homes for sale in Reno NV at a median listing price of 319900. Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357. Calculate a simple single sales tax and a total based on the entered tax percentage.

The current total local sales tax rate in Reno NV is 8265. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. 2022 Cost of Living Calculator for Taxes.

This is an increase of 18 of 1 percent on the sale of all tangible personal property that. You can print a 8265 sales. Our sales tax calculator will calculate the amount of tax due on a transaction.

Our Premium Cost of Living. This is the total of state county and city sales tax rates. Low property taxes and the absence of any state or local income.

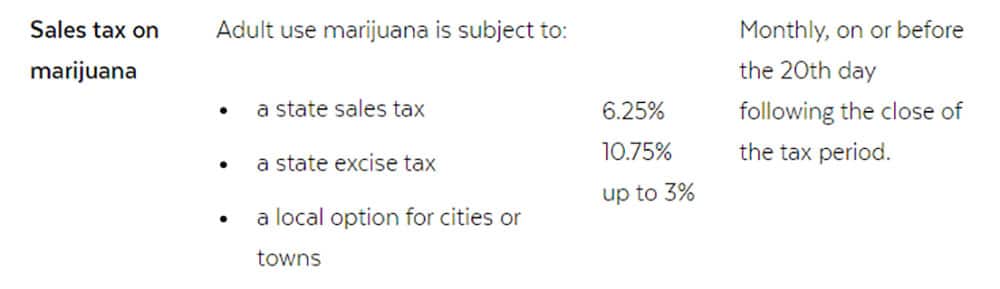

Reno NV Sales Tax Rate. 053 average effective rate. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

The calculator can also find the amount of tax included in a gross purchase amount. NV Sales Tax Rate. Find your Nevada combined.

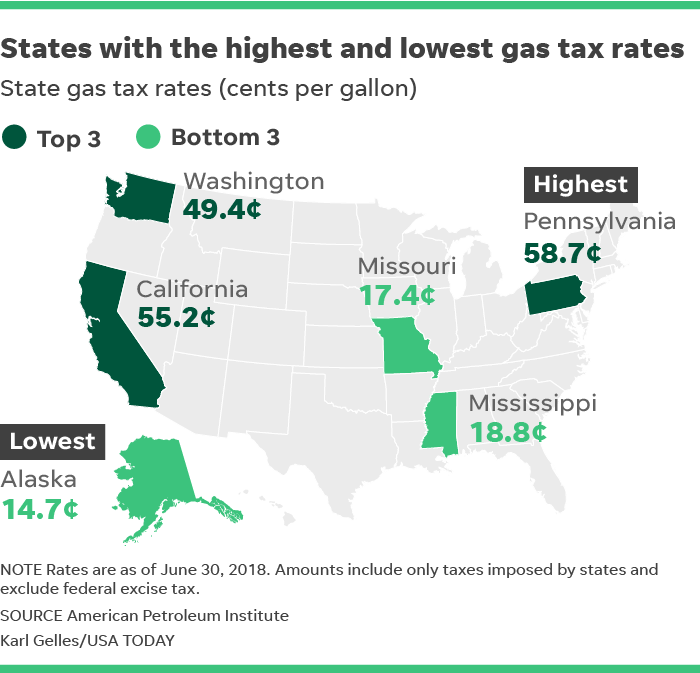

31 rows North Las Vegas NV Sales Tax Rate. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265. Therefore a home which has a.

The December 2020 total local sales tax rate was also 8265. The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375.

Sales Tax Nevada Reno. Depending on local municipalities the total tax rate can be as high as 8265. 2300 cents per gallon of regular gasoline.

Nevada Sales Tax Calculator The. The minimum combined 2022 sales tax rate for Reno Nevada is. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375.

Reno Nevada and Las Vegas Nevada. The County sales tax rate is. Pahrump NV Sales Tax Rate.

Nevada Vs California Taxes Explained Retirebetternow Com

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Nevada Income Tax Calculator Smartasset

2020 Nevada Sales Tax Form Sema Data Co Op

Nevada Income Tax Calculator Smartasset

2020 Nevada Sales Tax Form Sema Data Co Op

Nevada Sales Tax Small Business Guide Truic

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Nevada Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar

City Of Reno Property Tax City Of Reno

Marginal Tax Rate Calculator Heritage Bank Of Nevada

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

Sales Taxes In The United States Wikiwand

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings